Junk Bonds Sold to Investors to Fund Junk Content

Netflix announced Monday it is planning a $2 billion bond offering.

For those of you who slept through high school economics, what this means is Netflix will basically water down some bonds labeled “junk” by investors already, and then turn around and offer them for sale on the stock market to already over-leveraged investors hoping for a higher yield in the future.

The reason why companies do this is because, and I quote:

Junk bonds represent bonds issued by companies that are struggling financially and have a high risk of defaulting or not paying their interest payments or repaying the principal to investors.

Ain’t taking risks with other people’s money grand!

Investors Don’t Care If the Content Sucks. Make Money!!!

Netflix is issuing the junk bonds, all $2 billion dollars of them, in order to fund content acquisition, production and development, and potential acquisitions, among other reasons.

Junk bonds typically have a higher rate of return — again, for those of you who failed economics — because the opportunity for defaulting on the debt and going broke is higher, and because the opportunity for yield–that is return on investment–is higher as well.

And, with the way that competitors have been getting in the streaming content delivery pool, it appears that the rich sheep who are Netflix’s investors weren’t calmed by Reed Hastings’s comments last week, which we covered here.

And, I quote from the investor trades:

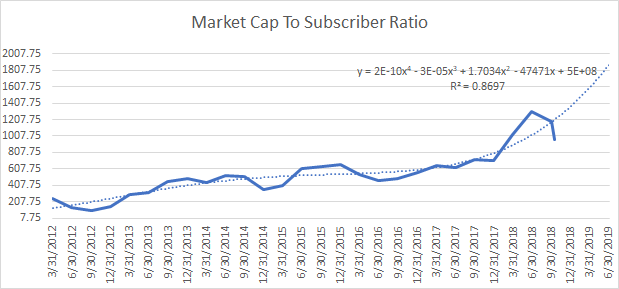

Just last week, Netflix acknowledged that the coming slew of competition may hurt new-subscriber growth. The company said it expects that subscriber growth will decline year-over-year in the usually strong fourth quarter and for the entire year, even with a strong slate of new shows.

“The launch of these new services will be noisy,” Netflix executives said in their quarterly letter to shareholders. “There may be some modest headwind to our near-term growth, and we have tried to factor that into our guidance.”

Uh-huh.

Ok, Hastings. Put on a happy face.

It remains to be seen if Netflix will default next quarter, or if they will stumble along as a “zombie” business at $50.00 per share.

Stay tuned.